Investing Weekly vs. Monthly: Which Strategy Wins?

| 3 minutes read

Shortly I had an interesting conversation with a friend of mine about investing. I started investing around 2018 in ETF’s and he started just recently.

We discussed the ETF’s to invest in and also the amount and frequency. TradeRepublic allows you to invest manually, weekly and monthly automated. So he asked me if it is better to invest weekly or monthly.

With the strategy to just invest in one ETF (MSCI World) without trying to time the market, it felt natural to invest more often to smoothen the curve even more.

I wasn’t convinced that it makes a difference. Since I am a developer, I had to make it more clear and wrote some code to find out.

So let’s see what is better…

Test Setup

I crawled the MSCI World data from 2012 on a daily base. GitHub Link.

We assume that the investing started 10 years ago until now. The Python code can be found here.

First Approach

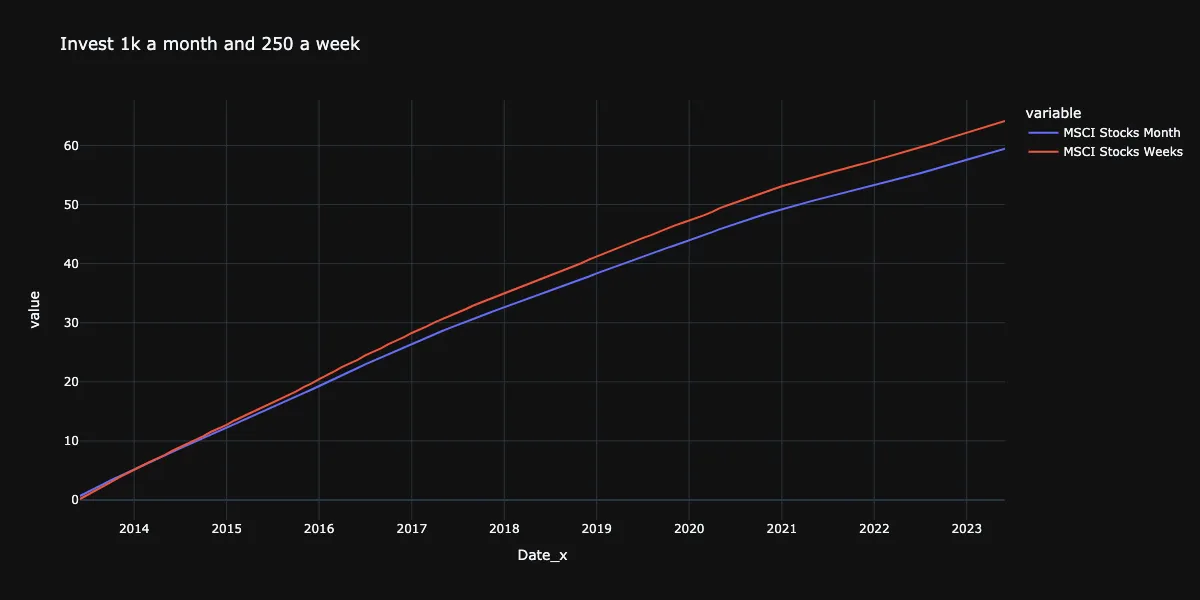

So assume Person A invests $1k a month and Person B invests $250 a week. Let’s see where we stand.

Here are the weekly investing wins. But why is this?

A year has 52 weeks and only 12 months. So if you invest monthly, you invest $12k a year. If you invest weekly, you invest $13k a year. Here the weekly approach wins clearly with a 7.89% advantage.

Same total amount of investment

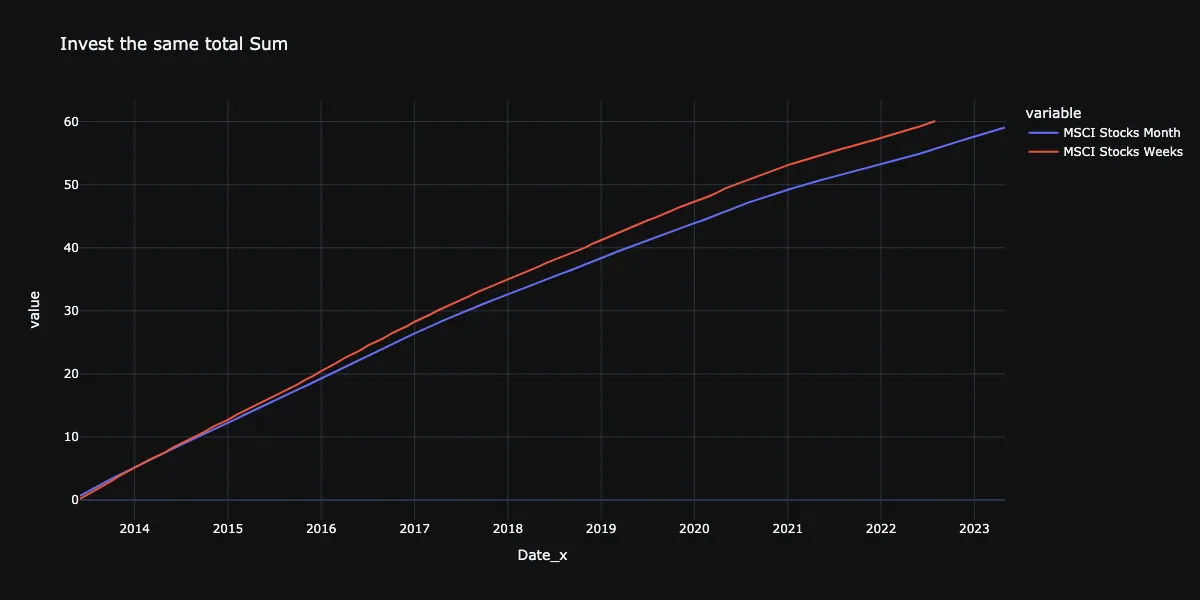

This isn’t a fair setup. So my second approach was, that you invest the same total sum, but the weekly setup is earlier. So after 10 years, both strategies invested the same sum, but the weekly investor invested earlier.

Since time in the market beats timing the market.

So we get closer. The weekly investor still has an advantage of 1.87%. As said, time in the market beats timing the market.

But still, this isn’t fair.

Fairest approach

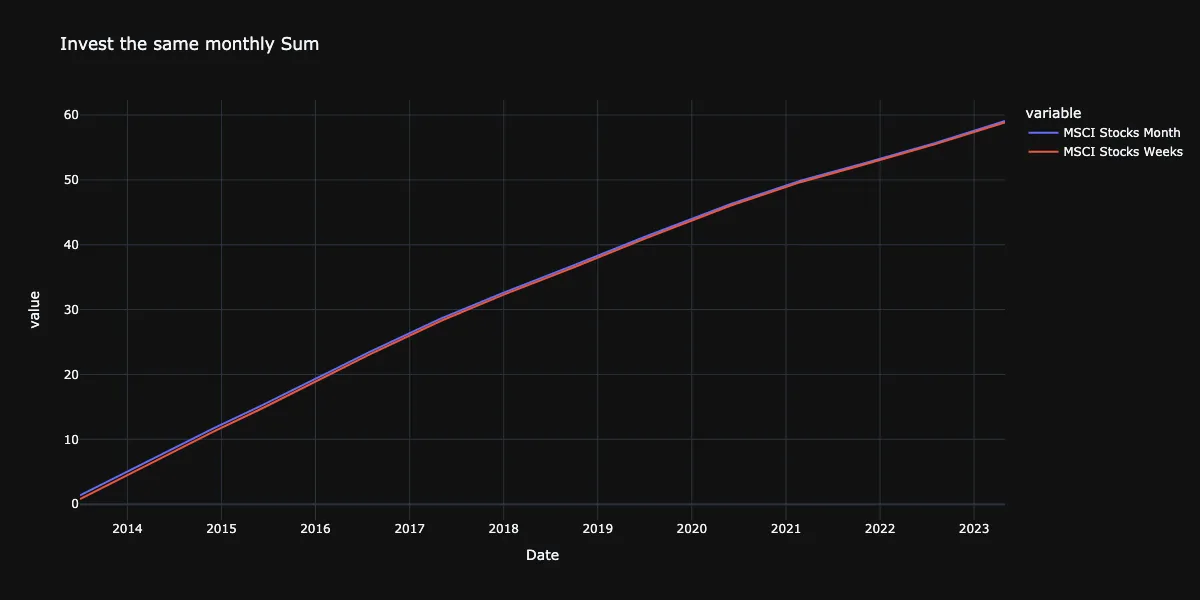

The fairest approach would be, that the sum every month is the same. So my last step was, that I calculated the total yearly investment sum on a monthly basis ($12k a year) and divided it by 52 (the weeks we have in a year).

So both Persons would invest the same amount in a year, but the weekly strategy is always a bit ahead of time.

Here we can see, the graphs are super close all the time. Also, there is a difference of 0.08%. This is nothing on 10 years.

Conclusion

Yes, if you invest your monthly sum on a weekly base, you have an advantage. Because you invest one month more on a yearly base. This is also why more expensive gyms advertise their prices on a weekly base. You just pay more.

But, if you invest the same amount of money in a year, there is no difference if you invest $250 a week or $1084 a month.

If you want to support this blog, you can buy me a coffee ☕️ or sign-up for my newsletter ✉️